What Does Survey Data Say About AI?

Agents that use smart systems tend to get smarter themselves. And when you can resolve problems more accurately in less time, you are bound to save a lot on your business’s customer service. If that is not enough, some AI-powered systems can even handle specific queries on their own. For instance, handling the most common questions means that companies can fully automate their front-end support. Above all, the back-end teams can improve accuracy and performance by using the information that automatically comes to them.

Let us see a few other reasons why AI customer service systems are the way of the future. In other words, what are 4 reasons why AI helps customer service?they do not have to spend the time to research better solutions themselves.

1. Solving customer service issues before they even arise

Because AI customer service tools can track customer behavior at all levels, they can predict customer problems before they even happen with deep learning systems. Therefore, predictions can be made by understanding how your customers interact with your brand and vice versa. We have seen this in the Zoho Intelligent Assistant (ZIA) included as part of Zoho One and Zoho CRM.

Above all, the most significant benefit of having automated customer service systems is that they can audit incredibly long lists of websites and applications. An AI-backed automated system can determine the distressful or illogical elements a customer might face during the buying process. The system may also be able to preempt the situation and provide a resolution even before the query comes up.

2. People need practice. AI does not

When you compare the cost of setting up a physical call center against AI customer service systems that cost way less, the latter has economic advantages. As the technology improves over time, AI automation should become unequivocally superior. Similarly, even if you already have a competent staff, processes might get revised with improved AI automation. After that, your team might need retraining. On the other hand, the design of automated customer support centers copes with any changes. The worst-case scenario is the need for reconfigurations or staff changes.

3. Creating a defined sense of reliability

However, if you wonder how you can cater to the customer with a complex issue that can only be attended to by a human, note that these AI-backed systems can typically transfer a query to a human manager/agent. The manager/agent chosen will then use the records and resources to address the customer’s problem. Therefore, with both the records and background of the complex issue, agents can solve problems much faster. Everyone should experience minimal frustration or the hassle that comes with handling simple calls from beginning to end.

4. Encouraging self-service processes to help customer service

The most crucial thing modern-day businesses should be able to do is effectively adapt to changing times. Those that do not adapt will eventually be outcompeted by those that do. As a business, you should be able to gauge what the current customer, as well as the upcoming customer, will need. The next generation of customers will have higher expectations and will be even more self-reliant. Therefore, developing automated, AI customer service systems now will be a competitive advantage in your near future.

How Can You Learn More About AI and Customer Service?

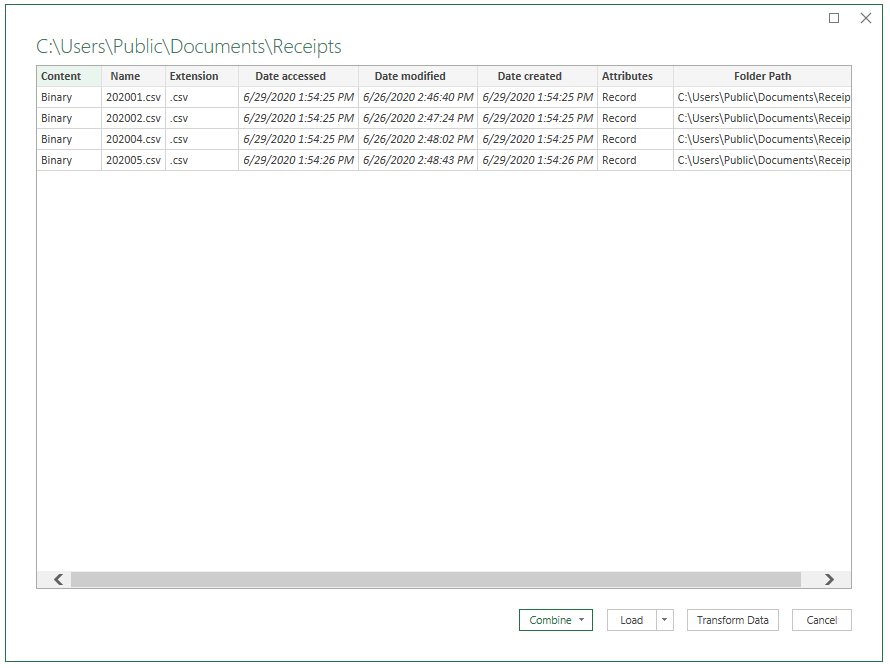

Understand the latest in emerging technologies, including AI, in our Emerging Technology courses. Learn about CRM here, or attend our CPD courses on accounting and customer support systems in small business accounting with add-ons or mid-market accounting, which includes cash flow systems.

RSS Feed

RSS Feed