What Are Management Reports?

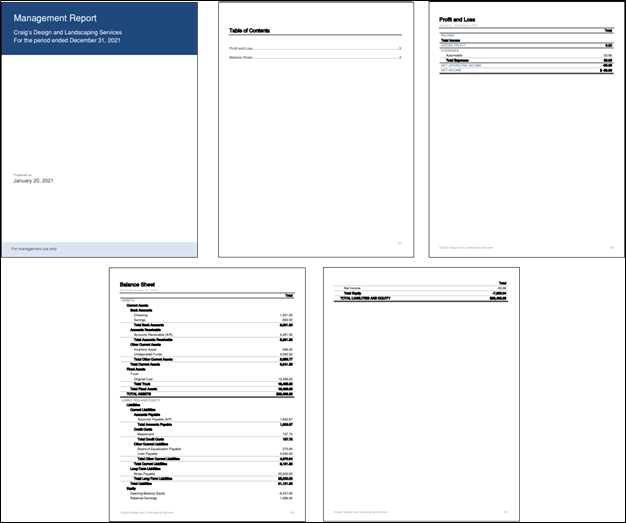

To clarify, Management Reports are “books” of user-defined, presentation-quality, customized reports. For example, these reports can contain cover pages, tables of contents, financial statements, operational information, compilation reports, and even management discussion and analysis commentaries. You can use any of the three pre-built Management Reports available in QuickBooks Online, or you can customize them to meet your needs and save them for future use. Further, you can distribute your management reports directly from within QuickBooks Online, save them as PDFs, or export them as Word documents for further editing.

Accessing QuickBooks Online Management Reports

If the report is suitable, can click Send, Export as PDF, or Export as DOCX in the Action column’s drop-down list. Then you can send it via email, export it to a PDF file or DOCX file, or share it using other means.

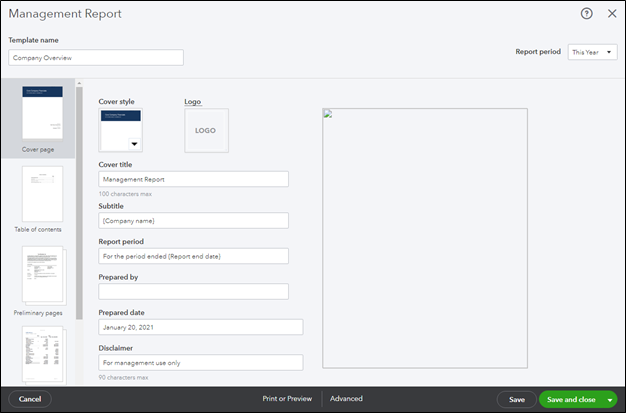

Customizing Your Management Report in QuickBooks Online

- Change the Template’s name,

- Edit the Cover Page’s style,

- Add a logo,

- Change the Title and Subtitle,

- Edit the Report Period,

- Add Prepared by and Prepared date fields,

- Add or edit Preliminary pages,

- Add other Reporting objects, and

- Add or edit End notes.

Upon completing your edits, click Save and Close in the lower right corner. Subsequently you can distribute the report using any of the techniques described previously. Of course, having saved the report, you can use it again in future periods, and all your customizations will appear automatically, saving you the time you would otherwise spend customizing that period’s reports.

Summary

Check Out These QuickBooks-Related Seminars from K2E Canada Inc.

Check Out These QuickBooks-Related Online Options from K2E Canada Inc.

|

Web-based Learning

|

On-Demand Learning

|

|

|

RSS Feed

RSS Feed